How to position your portfolio for rate hikes

Is your investment portfolio built to thrive when interest rates rise?

Now is a good time to find out. After years of low borrowing costs, rates appear to be headed higher as the U.S. economy improves, inflation ticks higher and jobs become easier to find.

After another month of strong hiring in February, when a better-than-expected 235,000 jobs were created, the Federal Reserve boosted rates Wednesday for the second time since December. And looking ahead, better business conditions and signs of inflation in consumer goods could prompt the U.S. central bank to hike borrowing costs four times this year, instead of the three the Fed anticipated back in December, notes Bill Stone chief investment strategist at PNC.

Fed rate increases are intended to keep the economy from overheating, as well as to rein in speculation on Wall Street.

In the past, certain investments have fared better than others under these conditions.

Here's an investment game plan to guide you through the oftentimes jolting transition from lower rates to higher rates:

* Stocks in the sweet spot

The stocks that perform best when borrowing costs rise are companies that do better when consumers are in a spending mood, businesses are in expansion mode, and overall confidence is high, which typically is the case in rate-hike periods.

In Fed rate hike cycles dating back to 1962, the types of large-company stocks that shine include technology names, energy producers, as well as industrial and transportation firms. These stocks are dubbed cyclical, because they do well when the economy is on an upswing.

The fact that the Fed has enough faith in the economy to boost rates is a good thing, says James Paulsen, chief investment strategist at Wells Capital Management.

"Finally, confidence in the future starts to dominate over fear," Paulsen explains, adding that the market is undergoing a character change that benefits stocks that can boost profits even as rates go up.

The stocks that make the least sense to own are companies deemed defensive, or those that pay out a lot of cash to investors in the form of dividends, and which investors flock to in tough times. Examples include utilities like electric and water companies, stocks in telecom that provide must-needed phones and other communications gadgets, as well as companies that sell everyday products, such as toilet tissue, cereal and liquor.

"When rates rise, these so-called bond proxies lose their attractiveness," says Sam Stovall, chief investment strategist at CFRA. Investors that found the current 3.6% yield on utility stocks attractive might view them as less enticing when bond yields move higher. Higher-yielding stocks, of course, also run the risk of seeing their share price fall.

With the economy strong, investors should not fear a Fed rate hike Wednesday, Paulsen says.

"We caution stock investors against becoming too pessimistic," he says. "The stock market may just continue to rumble (or go up.)"

* Best bonds to buy

In a rising rate environment, the price -- or the value of the principal -- of a bond falls. Boris Rjavinski, an interest rate strategist at Wells Fargo Securities, offers a number of strategies that bond investors can use to survive falling prices.

For buy-and-hold investors, Rjavinski stresses that any bond purchased outright can be held to maturity, at which time the investor will get back his full initial investment, as well as collect interest payments along the way. "As long as you don't sell the bond when prices fall and yields rise, you will get your principal back, assuming the borrower did not default," he says.

Another way to minimize losses is to own bonds with short maturities, such as a 2-year Treasury note instead of a longer-term one, such as a 10-year Treasury, says Dominic Pappalardo, a fixed-income portfolio manager at McDonnell Investment Management. Short-term bonds are less affected by rising yields and lower prices.

Rjavinski also highlights the benefits of "floating rate" bonds. Unlike investments that pay fixed rates, the payments on these bonds move higher along with short-term interest rates. That offsets the loss of principal from bond price declines. Bond investors looking to avoid financial harm from rising inflation should consider purchasing Treasury Inflation-Protected Securities, or TIPS. While the interest rate TIPS pay out remains constant, the principal amount "grows in line with the rate of increasing inflation," he explains.

Another strategy is to move out of lower-yielding U.S. government bonds and into higher-yielding corporate bonds, Pappalardo says.

"Corporate bonds have higher yields and, therefore, greater income streams," he says. "That extra yield provides a bigger cushion before you see negative total returns." Total return includes a bond's principal fluctuation and income stream.

* Cash plays to consider

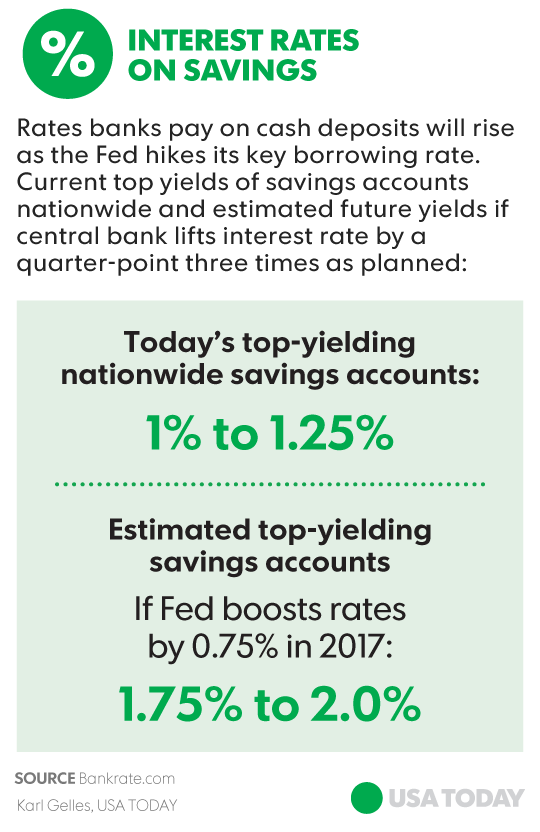

When the Fed hikes short-term rates, interest that banks pay out on savings accounts will also go up. But don't expect a windfall.

The top-yielding savings accounts available nationwide are now in a 1% to 1.25% range, according to Bankrate.com. So even if the Fed boosts rates three times this year, or three-quarters of a percentage point, bank account yields will rise to 1.75% to 2%, estimates Greg McBride, chief financial analyst at Bankrate.com.

"It helps savers," he says. But there's a caveat: The buying power of the still-low-yielding cash will be eaten up by inflation. The consumer price index, which measures the costs of everyday goods consumers buy, rose at a rate of 2.5% year-over-year in January. So even a 2% yield on savings won't be a big enough offset the higher prices.

But cash isn't about big returns. It's more about having a stash in case of emergencies or to deploy when opportunities to invest arise.

Says McBride: "You put money in cash for the return of your money, as opposed to return on your money."